| Applying for Direct Loans: |

| Loans are available to assist you(the student) in meeting your educational goals. |

| Complete the FAFSA, located online at www.studentaid.gov. Students will not be awarded any financial aid until all documentation/forms and transcripts requested by the CBC Financial Aid Office have been submitted and any necessary corrections made. |

| All students interested in borrowing a loan must contact the Financial Aid office for borrowing loan requirements. |

| CBC loan application and quiz will be emailed to students along with loan information requirements. |

| Students must go to www.studentaid.gov to complete their Master Promissory Note (MPN) and their Entrance Counseling. |

| Please allow two weeks from the date you complete entrance counseling and your CBC Loan Request before you receive the award letter. |

| These steps are the responsibility of the student and must be completed before you can receive loan funds. |

|

| TYPE OF LOANS |

|

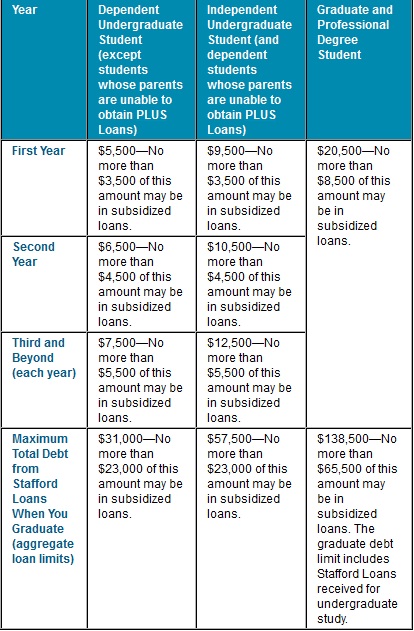

| Direct Subsidized Loans are based on financial need. The federal government pays the interest for the student during the following periods: |

|

| Direct Unsubsidized Loans are not based on financial need. Direct Unsubsidized Loans are for students who do not qualify for a subsidized loan or to supplement a student's subsidized loan. Students are responsible for all of the interest on unsubsidized loans. |

| Requirements to receive a loan |

|

| Entrance Counseling |

|

| Exit Counseling |

|

| IMPORTANT FACTS |

|

| The National Consumer Law Center recently published a report on the causes and effects of student loan defaults. It offers a comprehensive look at borrowers who default and what policymakers, consumers, and colleges can do to help address this growing problem. |

| Student Loan Borrower Assistance A Resourse for Borrowers, their Families and Advocates www.student loan borrowerassistance.org |